Energy

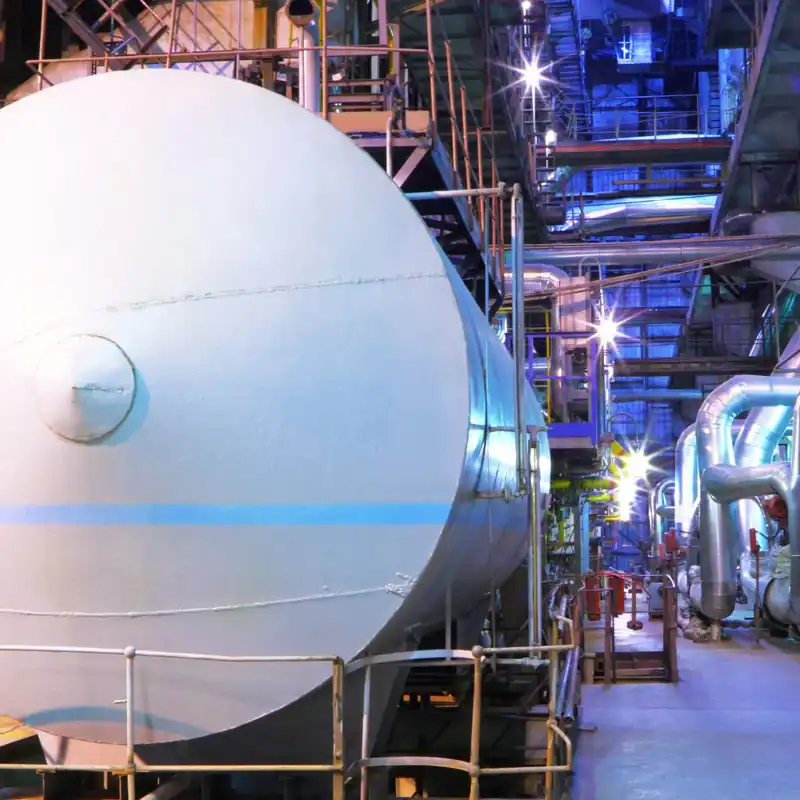

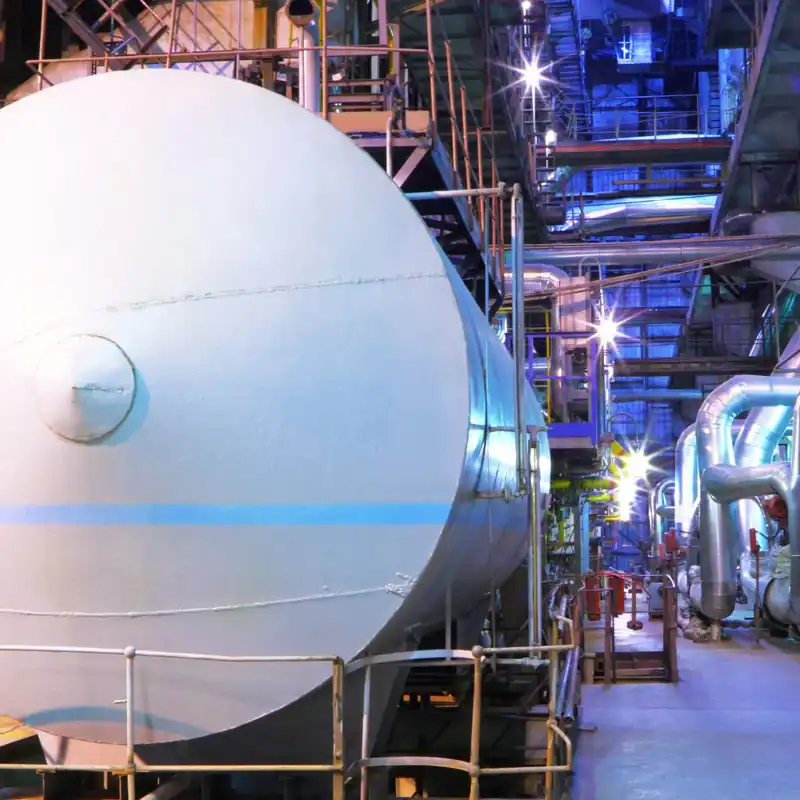

Protecting you against risk anywhere in the world you do business.The fundamental risks of the energy sector bring a high number of coverages to consider.

Doing business in the energy industry brings inherent risks due to potentially dangerous processes and equipment, natural disasters, legal compliance issues and more. NFP’s Energy team is an innovative brokerage group with more than 200 years of industry experience from various backgrounds and skillsets that can successfully develop comprehensive insurance programs and risk management solutions for these evolving environments.

We can generate actuarial modeling that measures and compares cash flow, loss forecasts, loss development and assists with captive structures. We can also assist clients in navigating ESG issues while keeping up with increased energy demand. Plus, we have vast experience handling large, complex claims and consulting beyond the traditional scope of claims support.

In sophisticated areas like the energy industry, the wrong step can lead to financial losses, injuries, loss of life and reputational damage. We can be your dedicated partner to help turn seemingly immeasurable risk into immense reward.

Who We Are

NFP’s Energy team has built solid relationships with domestic and international energy and power underwriters. Our team has the unique ability to customize energy insurance coverage at the most competitive rates.

Our specialists provide a comprehensive risk analysis to design and develop effective energy insurance programs with the highest long-term value for your business. We offer a broad range of energy insurance coverages to ensure that your business and its mission, employees and equipment are protected.

Our team is comprised of experts who’ve successfully managed some of the largest and most complex insurance placements in the energy industry. Whether your business is related to energy, power generation or renewables, we can help you operate with confidence, unhindered by risk.

We are specialists with clients in a variety of sectors, including energy, power generation and renewables. We can help you manage your risk to the following exposures – and more:

Who We Serve

Upstream

Oil and Gas

Oilfield Service Contractors

Transportation

Exploration and Production

Drilling Contractors

Hydraulic Fracturing

Offshore Oil and Gas

Midstream/Downstream/Mining

Including Gas Processing and Storage

Terminals

Refineries

Liquid Natural Gas Regasification

Pipelines

Commodity Traders

Mining

Manufacturing

Chemical/Petrochemical

Power Generation

Hydroelectric

Gas-Fired

Data Centers (with power generation component)

Coal-Fired

Geothermal

Transmission and Distribution

Diesel-Fired

Hosting Digital Mining Facilities

Renewables

Wind

Battery Energy Storage Systems (BESS)

Hydrogen

Carbon capture sequestration

Solar

Upstream

Oil and Gas

Oilfield Service Contractors

Transportation

Exploration and Production

Drilling Contractors

Hydraulic Fracturing

Offshore Oil and Gas

Midstream/Downstream/Mining

Including Gas Processing and Storage

Terminals

Refineries

Liquid Natural Gas Regasification

Pipelines

Commodity Traders

Mining

Manufacturing

Chemical/Petrochemical

Power Generation

Hydroelectric

Gas-Fired

Data Centers (with power generation component)

Coal-Fired

Geothermal

Transmission and Distribution

Diesel-Fired

Hosting Digital Mining Facilities

Renewables

Wind

Battery Energy Storage Systems (BESS)

Hydrogen

Carbon capture sequestration

Solar

Significant risk exposures are a reality of the construction industry. Every operation brings a unique set of challenges and it takes specialized expertise and solutions to overcome them. Understanding the intricacies of each project – and having the reach and relationships to provide comprehensive, cost-effective solutions – allows our Construction Services Group to continuously deliver the depth, breadth and quality that leaders from across the construction industry have come to expect from us.

We understand the inherent complexities faced by organizations in the cybersecurity space. We partner with you to create a fully integrated approach to risk management including risk mitigation and transfer mechanisms. The result is a tailored cyber liability solution best suited to your organization’s needs.

Serving on a company’s board or in a management or executive position carries a whole host of responsibilities and duties to various stakeholders. There is a duty to shareholders, employees, customers, clients, vendors, competitors, regulators and creditors — to name a few.

Unfortunately, things don’t always go smoothly, and if a director or officer fails to carry out duties, claims can and do result. In order to protect your company and individual directors and officers in the event of a claim, it is vital that your company is ready to respond.

Liabilities stemming from environmental issues and damage are often neglected, underestimated and can be dire. Understanding the risks and associated liabilities arising from direct actions and/or indirect actions can help you mitigate those issues.

Our understanding of commercial insurance within the energy sector allows us to provide top-flight coverage maximizing environmental insurance recoveries for you if and when a loss occurs.

When systems, utilities or machinery fails, a quick response is necessary to determine the cause of the failure and mitigate loss – but it can also be costly.

Our team can help find you a tailored forensics policy to cover the costs associated with investigating the cause of an explosion, shipping accident, oil spill and more. These costs can also cover the hiring of experts and specialists, conducting tests and analysis and legal proceedings, allowing you to protect your business in times of catastrophic events.

Businesses and the leaders who manage them face a wide variety of risks in today’s ever-changing world and corporate climate, and mitigation of executive risk exposure should be a key priority for organizations.

Our team can help you better understand current and future risks and assist your firm with overcoming the significant challenges your leaders and proxies face. We will help you source cost-effective solutions to your unique management and professional liability exposures with appropriate coverage solutions, including both alternative risk transfer mechanisms and more traditional insurance programs.

If your important assets don't stay in one place, they may not be best served by traditional property insurance. Moveable assets – and you'd be surprised what this might entail – whether in transit or at a fixed location, may be better served by a specialized marine insurance policy format.

With decades of experience in surety, our team has a national reputation within the surety industry. Our background enables us to offer our clients a unique insider’s perspective on the underwriting process, business and risk management philosophies and claims approach of major surety writers.

We maintain strong, long-term relationships with regional and national decision-makers at the leading sureties and continually monitor market conditions and industry changes to better serve our contractor clients.

Plus, our nationally recognized team of senior surety professionals are focused on positioning your organization with the capacity, terms, and pricing it needs to capitalize on opportunities in the highly competitive energy and marine industries.

Trade credit insurance transfers the uncertainty of customer payment to an underwriter so you can focus on managing and growing your business. Partnering with a trade credit insurer will lead to a higher-quality customer portfolio and lower overall credit losses.

The benefits of trade credit insurance go well beyond the obvious protection against bad debt losses, and our team can assist you in securing the coverage you need. Many of the benefits can be quantified, offsetting the incremental premium spend.

Products

The global risk landscape is evolving at an incredible rate, which is leaving many organizations without meaningful risk transfer options in the conventional insurance market.

We specialize in helping our clients determine if a captive insurance company is a valuable business solution to augment their existing risk transfer strategies.

Services include:

- Pre-feasibility Studies

- Feasibility Studies

- Business Plan Development and Implementation Support

- Strategic Utilization

- Corporate Governance Review

We employ a logical approach in the transformation of data into decision-making.

Our integrated team-based approach distinguishes us. We integrate broking, engineering, claims, financial analysis and quantitative analytical support to enhance the understanding and quantification of risk. Our differentiation is your advantage.

Specific services include:

- Analytical Support (Uncovering and quantifying risk)

- Risk Assessment (ERM) Facilitation (Development of framework)

- Probabilistic Loss Analysis (Risk quantification)

- Risk Bearing Capacity (Financial quantification)

- Customized Risk Modeling (Including business interruption)

Your business relies on your employees to make daily choices that align with regulations and promote a culture of safety. Unfortunately, the safest practices aren’t always obvious. But with the right knowledge and tools, any company can achieve a healthier culture and lower overall risk.

We can work with you to apply and integrate key guidance and compliance requirements to build successful practices. Our aim is to increase operational effectiveness and maximize defensible measures. This includes compliance, best practices and more.

If a claim occurs, it is our top priority because we take our partnership seriously. Our “firm within a firm” structure allows us to personalize our claims service to fit your needs without competing with hundreds of other client accounts yet still providing the resources of a large brokerage.

When advancing your claim, we bring to you all of the benefits of our years of experience coupled with decades of handling large losses across the natural resource, energy, power generation and transportation sectors.

Our engineering and loss control services are based on the belief that prior planning prevents poor performance. We deliver site visits that provide the current and prospective property, machinery, liability, environment and construction underwriters the opportunity to get first-person visibility to the operations through their engineering representatives.

Working with an expert to develop and implement a customized risk transfer plan creates a path for your business to thrive well into the future.

Our team crafts custom solutions designed to reduce volatility, increase capacity and improve operating performance across all lines of business. We’ll stay by your side every step of the way to make sure your program is precisely what you’re looking for and administered to your exact needs.

In addition, we’re proud to provide access to NFP’s network and resources to help our clients expand their distribution, lines of business and profits.

Risks change, evolve, emerge, intensify and can appear with little warning, which is why crafting a risk management and complex risk insurance policy is an ongoing process.

From retained risk to claims management, our team has experience simplifying the complicated and delivering highly customized, multi-line, multi-year insurance packages that include integrated risk and structured risk programs.

Services

We know that every step forward in the energy industry comes with its own set of risks and opportunities. That’s why we’re here for you. Our goal is to partner with you to create personalized strategies that not only protect your valuable assets but also align with your long-term vision. Together, we can navigate the challenges ahead and help your business thrive.

Latest Insights

Reach out today to start a conversation about how we can work together to move you forward.